Over 3.2 lakh sellers in Tamil Nadu didn’t pay a single rupee in GST final 12 months

Round 30% of the sellers registered with Tamil Nadu’s Business Taxes Division (3.26 lakh) didn’t pay a single rupee within the Items and Providers Tax (GST) throughout 2021-22. Moreover, about 1.94 lakh sellers had paid lower than ₹1,000 all year long.

These findings have been made via a latest examine carried out by the Division of the tax remittances. There are about 11 lakh registered sellers within the State, of whom 6.72 lakh come underneath the State jurisdiction and the remaining underneath the Centre. The edge for the registration of taxpayers dealing in items is ₹40 lakh and for these dealing in companies ₹20 lakh.

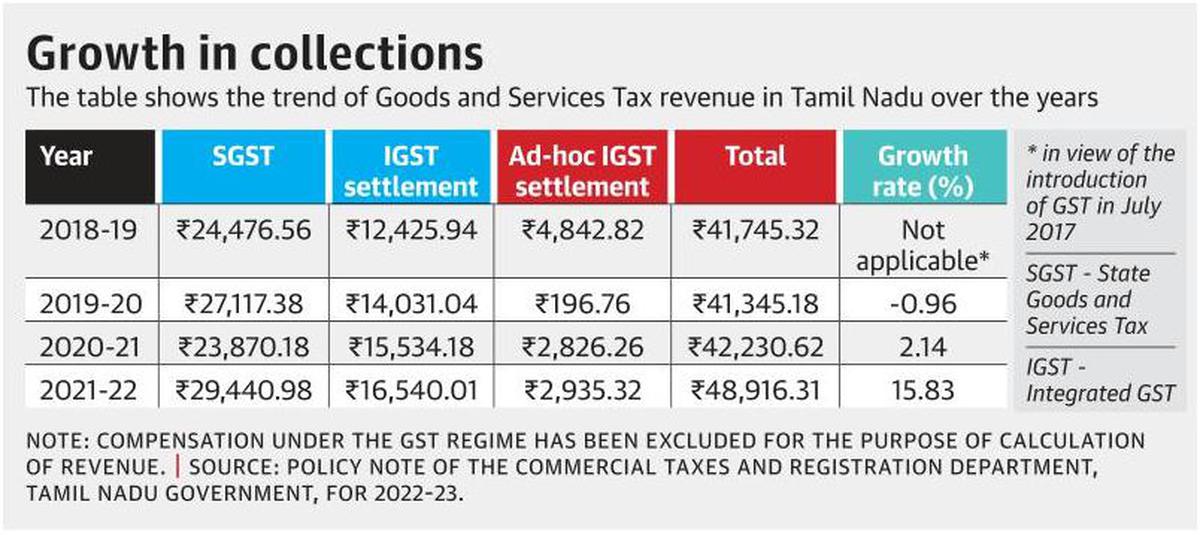

Although the earlier monetary 12 months’s income collections of the GST, by way of year-on-year progress, noticed a optimistic charge of 15.83%, the very best in a full monetary 12 months for the reason that GST was launched in July 2017, the authorities had been plugging the loopholes within the tax assortment mechanism. Therefore, the examine was carried out. The GST income collections comprise three parts — State GST (SGST), Built-in GST (IGST) settlement and ad-hoc IGST settlement. Compensation has not been taken under consideration for calculating the GST income collections.

Moreover, a perusal of the month-to-month GST assortment knowledge, as launched by the Centre within the final six months, reveals that Tamil Nadu had registered a tepid progress over the corresponding months within the earlier 12 months, whereas Maharashtra and Karnataka, regardless of having a better base, had carried out higher than Tamil Nadu.

After the examine, Tamil Nadu Business Taxes Division despatched communication to five.2 lakh sellers, “requesting” them to test their accounts.

Requested whether or not the nil or negligible cost of tax might be thought-about tax evasion, a senior official of the Business Taxes Division mentioned, “Proper now, such a conclusion can’t be arrived at. For that, we should peruse accounts of the sellers totally.”

After the examine, the Division despatched communication to five.2 lakh sellers, “requesting” them to test their accounts. This initiative had its personal affect, prompting 22,430 sellers to pay about ₹64.22 crore in Might. “In the intervening time, persuasion is our coverage with regard to getting again the tax because of the authorities,” factors out the official.

Observing that not each one of many 5.2 lakh sellers can declare to have carried out enterprise inside the edge, the official says the cost of tax has change into a necessity as patrons, particularly these belonging to micro, small and medium enterprises, wish to avail themselves of enter tax credit score.

One other measure initiated by the Division is to observe those that have opted for the composition scheme of taxation with a charge of 1% for merchants and producers whose combination annual turnover is as much as ₹1.5 crore. There are round 60,000 sellers who’ve joined the scheme. The purpose is to determine whether or not such sellers have recorded a turnover in extra of the permissible stage. Consequently, 28 sellers have been chosen for inspection of accounts. In consequence, over 1, 220 sellers have opted out of the composition scheme and registered themselves as common sellers. Final month, they paid ₹84 lakh in tax.

Attributable to numerous enforcement measures taken by the Division, the variety of taxpayers touched an “all time excessive” of three.66 lakh throughout April 2022. Within the corresponding month of 2021 (marking the start of the second 12 months of the COVID-19 pandemic), the determine was 3.33 lakh, the official notes.

from Tadka News https://ift.tt/jLCPkoy

via NEW MOVIE DOWNLOAD

Labels: Tadka News

0 Comments:

Post a Comment

Note: only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home